HELOC Rates and Payments

Each day we read in the paper or hear on the news some form of conflicting political rhetoric about why our economy is bouncing back and how the claims for unemployment are going down. On the flip side, you read just as many articles that claim the “Great Recession” is not over. What we do know for a fact is that the mortgage crisis occurred when hard working Americans could no longer afford their homes and were forced into foreclosure.

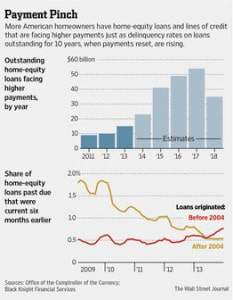

The looming issue has now become home-equity lines of credit, known as HELOC’s. These loans allow homeowners to use the equity in their homes to fund various expenses (home improvement, college tuition etc.). Typically borrowers are allowed to make interest only payments for a set amount of years, 10 years being the most common. According to Nick Timiraos of the Wall Street Journal, the culmination and downfall of these interest only HELOC’s will hit this year. This could mean that many people will see their HELOC rates increase and more than double in payment.

The graphic, from the article in the Wall Street Journal, show the potential doom that many homeowners face. As this article points out, some of the states that benefited from the housing boom years ago (AZ, CA, NV & FL) could be effected the most. If you are in need of some assistance with your HELOC rates, it may be wise to contact a qualified debt settlement attorney. An attorney experienced in this kind of work can likely assist you in settling your HELOC for less than you owe without the need for bankruptcy or foreclosure.

The graphic, from the article in the Wall Street Journal, show the potential doom that many homeowners face. As this article points out, some of the states that benefited from the housing boom years ago (AZ, CA, NV & FL) could be effected the most. If you are in need of some assistance with your HELOC rates, it may be wise to contact a qualified debt settlement attorney. An attorney experienced in this kind of work can likely assist you in settling your HELOC for less than you owe without the need for bankruptcy or foreclosure.